India’s PAN 2.0 program is set to drastically change how individuals and businesses manage their tax and regulatory obligations. The recently announced upgraded Permanent Account Number (PAN) serves as a standard corporate identity in a number of tax and regulatory domains and has a more streamlined and digitalized structure.

What is PAN 2.0?

PAN 2.0 builds upon the core purpose of PAN as a tax identifier by extending its use as a common company identity across several government platforms. In keeping with India’s broader digitalization goals, this modification ensures that compliance processes are integrated and streamlined.

Within the updated framework:

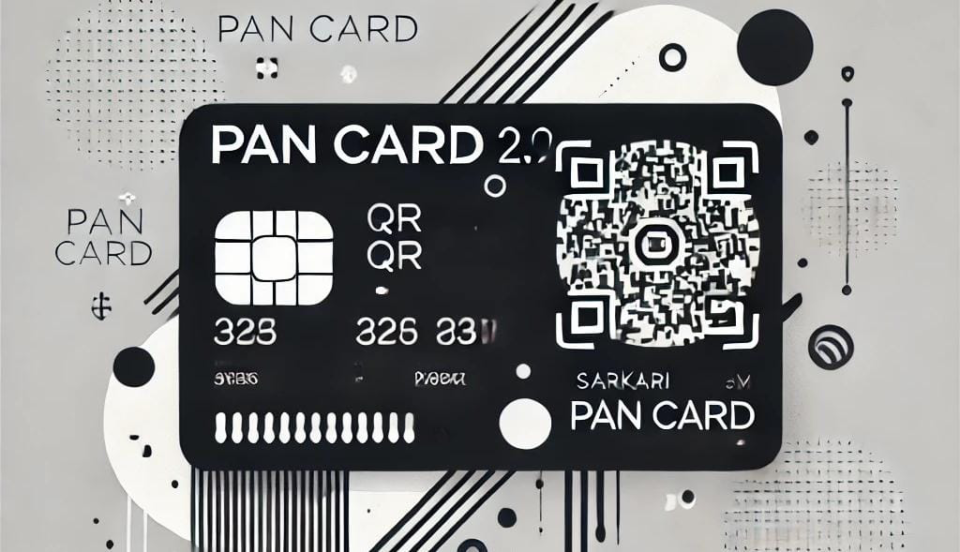

PAN will serve as a single identity for a number of legal requirements, such as business incorporations, GST registration, and TDS filings. It has advanced technologies including dynamic QR codes for better verification and DigiLocker-style secure digital storage techniques.

Key Features of PAN 2.0

Unified Business Identifier: PAN 2.0 combines multiple business identifiers, such as CIN, TAN, and GSTN, to form a single system. This reduces redundancy and simplifies compliance, especially for small and medium-sized enterprises (SMEs).

Dynamic QR Codes: Organizations will find it easier to swiftly verify authenticity thanks to PAN cards’ dynamic QR code that contains the holder’s photo, signature, and other personal information.

PAN Data Vault: A vault similar to DigiLocker will ensure the secure storage of PAN-related data, enhancing cybersecurity and reducing the likelihood of misuse, claims India Today.

Simplified Access: The Income Tax Department will house services like PAN issuance, corrections, Aadhaar-PAN linking, and e-PAN requests on a single site in order to enhance user experience and operational efficiency.

Benefits for Taxpayers and Businesses

Ease of Doing Business: By merging several IDs and reducing paperwork, PAN 2.0 helps businesses overcome long-standing compliance problems and improves the regulatory environment.

Cost Efficiency: Since streamlined processes would save administrative costs and time spent on regulatory filings, small businesses stand to gain the most.

Better Transparency: The consistent identifier promotes a more equal tax environment by enabling better government supervision and reducing the likelihood of tax evasion.

Digital Transformation: The data vault system and dynamic QR code show India’s commitment to cybersecurity and digitization in accordance with global best practices.

Individuals can link additional financial data and file taxes more easily using PAN 2.0. It also ensures quick verification for high-value transactions, such as investments, real estate purchases, and credit applications. Users can feel more at ease knowing that PAN information is less likely to be misused thanks to improved data security procedures.

Challenges and Concerns

Despite the revolutionary advancements that PAN 2.0 promises, its successful implementation requires overcoming a few challenges:

Integration with Current Systems: PAN 2.0’s ability to work with legacy systems like GST and EPFO will be crucial to a smooth transition.

Awareness and Adoption: It is essential to educate taxpayers and companies about the features and benefits of PAN 2.0 in order to encourage widespread adoption.

First Barriers to Adaptation: Businesses may have minor difficulties during the transition process, particularly when modifying internal systems to accommodate the new framework.

The Future of PAN 2.0

Rather than merely changing regulations, PAN 2.0 is a step toward creating a digital, secure, and transparent tax ecosystem. Its success could pave the way for more governance innovations, such the use of blockchain technology for accounting or artificial intelligence to forecast taxes.

By reducing bureaucratic red tape and fostering digital integration, PAN 2.0 helps India achieve its objective of being a global hub for commerce and innovation. The government’s commitment to efficiency and transparency is demonstrated by initiatives such as this one, which will undoubtedly facilitate business dealings and improve the lives of millions of taxpayers.

In terms of simplifying compliance and empowering both individuals and businesses, PAN 2.0 is a significant positive move. The potential benefits, which have the ability to completely transform India’s regulatory landscape, much exceed the challenges that now exist. As this system is put into place, businesses and taxpayers will need to adapt to this revolutionary change by staying informed and alert.

FAQs

What is PAN 2.0?

The PAN 2.0 Project is an e-Government initiative by ITD to improve the process of taxpayer registration. The goal is to improve PAN services by using the latest technology.

Do you need to change your PAN number?

No. The existing PAN card holders are not required to apply for new PAN under the

upgraded system (PAN 2.0).

Do I need to change my PAN card under the PAN 2.0?

No. The PAN card will not be changed unless the PAN holders want any

update / correction. The existing valid PAN cards will continue to be valid under PAN

2.0.

WHAT ARE THE STEPS TO APPLY FOR PAN 2.0 ONLINE?

Applying for PAN 2.0 is hassle-free, user-friendly, and entirely online. Follow these steps:

Visit the unified portal: Once the PAN 2.0 platform is launched, all PAN and TAN-related services will be accessible on a single portal.

Provide personal details: Enter the relevant fields with personal information.

Upload necessary documents: Attach scanned copies of identity, address, and proof of date of birth.

Submit the application: Review the information and submit the application securely.

Whether Common Business identifier will replace the existing unique taxpayer identification number i.e. PAN?

No. PAN itself will be used as a Common Business identifier.

Do you need to apply for the e-version of PAN 2.0?

The current PAN card will still be valid under PAN 2.0, and holders will automatically receive an electronic version of their card by email, without needing to apply.